Navigating the complexities of unemployment benefits can feel overwhelming, especially during times of uncertainty. But fear not, we’ve got you covered! In this comprehensive guide, we’ll provide a step-by-step walkthrough on how to apply for unemployment benefits, ensuring you’re well-equipped to take on this process with ease and confidence.

From understanding unemployment insurance benefits to maintaining health coverage after losing employment, we’ll delve into every aspect you need to know, empowering you to secure the financial assistance you rightfully deserve. So, let’s dive in and master the art of navigating unemployment benefits together!

Table of contents

- Key Takeaways

- Understanding Unemployment Insurance Benefits

- Determining Your Eligibility for Unemployment Benefits

- Gathering Necessary Information to File a Claim

- Steps to Apply for Unemployment Benefits

- After Filing Your Initial Claim

- Navigating Unemployment Assistance from Other States

- Avoiding Unemployment Scams and Protecting Your Information

- Maintaining Health Coverage After Losing Employment

- Summary

- Frequently Asked Questions

Key Takeaways

- Understand unemployment insurance benefits and eligibility criteria.

- Gather necessary documents to file a claim, then apply for benefits using an online or other method.

- Take proactive steps to protect your information from scams and maintain health coverage after losing employment.

Understanding Unemployment Insurance Benefits

Unemployment insurance benefits, also known as ui benefits or unemployment compensation, serve as a financial lifeline for eligible workers who have involuntarily lost their jobs. Governed by the unemployment insurance program, these benefits provide temporary financial aid in the form of weekly benefit amounts to qualified individuals.

The unemployment insurance program primarily acts as a safety net for workers who have experienced lost employment in covered employment, cushioning financial challenges while they hunt for new job opportunities.

Next, we’ll delve into the specifics of the program, focusing on the calculation of weekly benefits and the eligibility criteria for recipients.

Unemployment Insurance Program

The Unemployment Insurance Program supports individuals who have lost their job through no fault of their own by providing financial assistance in the form of a weekly benefit amount. This vital program adheres to federal law, requiring eligible workers to satisfy certain conditions, such as having worked for a specific duration and earned a specified amount of wages.

The Unemployment Insurance Program offers a temporary financial buffer, allowing workers to concentrate on job hunting without additional financial stress. With the program’s role understood, we’ll now examine the calculation of weekly benefit amounts.

Weekly Benefit Amounts

Weekly benefit amounts are calculated based on the amount of wages earned in the base period, which consists of the first four of the last five completed calendar quarters before submitting your claim. Essentially, this means that your weekly benefit amount depends on your earnings during this specific timeframe.

By determining your weekly benefit amount using this calculation, the unemployment insurance program ensures that the financial assistance you receive is tailored to your individual circumstances, providing a fair and balanced support system for those in need.

Now that we’ve explained unemployment insurance benefits, we’ll proceed to discuss eligibility criteria.

Determining Your Eligibility for Unemployment Benefits

Eligibility for unemployment benefits is determined by each state, with criteria often including factors such as:

- Involuntary job loss

- Having earned sufficient wages within a specific duration

- Being physically and mentally capable of working

- Actively searching for employment

While these general conditions apply to most workers, it’s essential to recognize that self-employed individuals and business owners may also qualify for unemployment benefits under certain circumstances. Let’s explore this further by examining the eligibility criteria for different categories of workers.

Eligible Workers

Eligible workers are those who have earned sufficient wages during the base period and are either totally or partially unemployed. Each state has its own eligibility criteria, but typically an individual must be unemployed through no fault of their own and actively seeking employment to qualify for benefits.

The unemployment insurance program efficiently allocates financial aid to the truly needy by confirming that eligible workers meet these requirements.

How about self-employed individuals and business owners? Their eligibility for unemployment benefits will be our next topic.

Self-Employed and Business Owners

Self-employed individuals and business owners may be eligible for unemployment benefits if their income has been negatively impacted by events such as the COVID-19 pandemic. To qualify, these individuals must meet specific stipulations, such as experiencing a decrease in income, having earned a certain amount of income in the past year, and having worked a certain number of hours in the past year.

The procedure for filing a claim for unemployment benefits is similar for self-employed and business owners as it is for other workers. They must first gather the required data to file a claim, such as evidence of income and work history, and then file their claim either online or through alternative application methods.

After submitting their initial claim, they must wait for a waiting period and certify for benefits.

Gathering Necessary Information to File a Claim

To file a claim for unemployment benefits, you’ll need to provide specific documents and information. These requirements usually consist of evidence of identity, evidence of employment, and evidence of income.

Having this information readily available will streamline the application process, allowing you to file your claim with minimal delays. With all the necessary information at hand, you’re ready to proceed with the application for unemployment benefits.

Steps to Apply for Unemployment Benefits

Applying for unemployment benefits can be done through various methods, such as:

- Online applications

- Phone

- Fax

Each state may have specific requirements and procedures, so it’s essential to familiarize yourself with your state’s application process to ensure a smooth experience.

Regardless of your preferred method – online or alternative – understanding the application steps is key. We’ll delve deeper into these methods, beginning with online filing.

Filing Online

Filing for unemployment benefits online is a convenient and efficient method that requires your Social Security number, driver’s license or state ID, and proof of your employment history. The online filing process entails creating an account, supplying the required information, and submitting the application.

After submitting your application, log into your account to view and track its status. You can sign in and make any necessary changes to your application.

Other Application Methods

If you’re unable to file for unemployment benefits online or prefer an alternative method, you can submit your claim via phone, fax, or mail. Keep in mind that the toll-free numbers for filing a claim by phone are accessible Monday through Friday from 8 a.m. to 5 p.m. Pacific time does not include state holidays. Exceptions may be made in certain situations..

It’s important to provide accurate and complete information, irrespective of your chosen application method, to facilitate a smooth process. After successfully filing your initial claim, a few more steps remain before you start receiving your unemployment benefits.

After Filing Your Initial Claim

After submitting your initial unemployment claim, you might have to go through an unpaid waiting period before receiving benefits. The waiting week ensures only those truly needing benefits receive them.

In addition to the waiting period, which usually takes two to three weeks, you’ll need to certify for benefits every two weeks after filing your claim. This process checks your eligibility for unemployment benefits and confirms you meet ongoing assistance requirements.

The Waiting Period

Before receiving unemployment insurance benefits, you must fulfill a one-week unpaid waiting period on your claim. This is a mandatory requirement. You must certify for benefits and meet all eligibility requirements for that week before serving the waiting period.

The waiting period helps allocate benefits to genuine applicants. After this period, you must continually certify to stay eligible.

Certifying for Benefits

Certifying for benefits is a crucial step in the unemployment benefits process, as it involves verifying your eligibility for unemployment insurance benefits every two weeks. By certifying for benefits biweekly, you ensure that you consistently receive benefit payments.

To certify for unemployment benefits after filing an initial claim, you can do so every 14 days from the date indicated on your claim form, either online through UI Online or by phone using EDD Tele-Cert at 1-866-333-4606. Adhering to this process will keep you eligible for benefits as you seek new job opportunities.

Navigating Unemployment Assistance from Other States

If you’ve worked in a different state than where you currently reside, you may need to navigate unemployment assistance from that state. To receive unemployment assistance from other states, you should file your claim with the state where you worked.

It’s important to note that it’s generally not permissible to receive benefits from multiple states. Understanding the process of receiving benefits from other states can smooth your path as you seek financial support during unemployment.

Avoiding Unemployment Scams and Protecting Your Information

Fraudsters target those seeking unemployment benefits using phishing emails, fake websites, and calls to get personal information. Vigilance and proactive steps to protect personal information are paramount for shielding yourself from scams.

Some ways to ensure the security of your personal information include utilizing strong passwords, abstaining from public Wi-Fi networks, and enabling two-factor authentication. Report suspected fraudulent activity to your state’s unemployment office or the Federal Trade Commission.

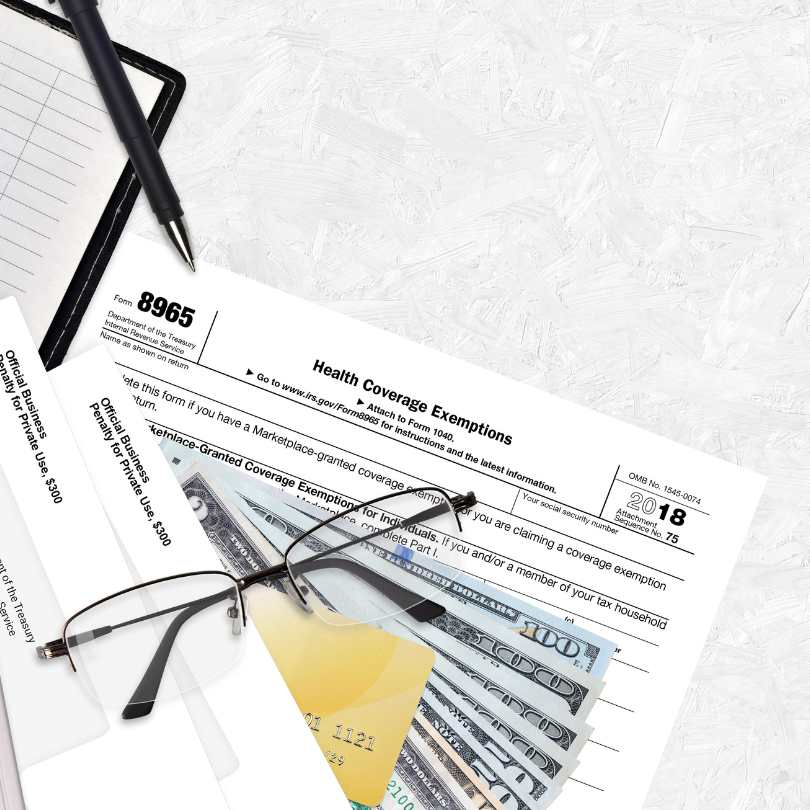

Maintaining Health Coverage After Losing Employment

Losing employment can also impact your health coverage, but there are options available to maintain your coverage. Some options include:

- COBRA, the Consolidated Omnibus Budget Reconciliation Act, which allows you to continue your employer-sponsored health insurance by paying the full premium

- Enrolling in ACA-compliant coverage through the Health Insurance Marketplace

- Exploring short-term insurance plans

- Checking your eligibility for Medicaid

- Joining a family member’s health insurance plan

Prompt action and exploration of these options within the given timeframes are vital to retaining your health coverage post-employment loss. Such measures will guarantee continued access to necessary healthcare services for you and your family during challenging times.

Summary

We’ve explored applying for unemployment benefits, understanding the insurance program, and maintaining health coverage post-job loss. Follow this step-by-step guide to confidently and easily tackle the unemployment benefits application process.

Remember, although navigating unemployment benefits may seem daunting, you’re not alone. With persistence and determination, you’ll secure the financial assistance you need, allowing you to focus on finding new employment opportunities and forging ahead towards a brighter future.

Frequently Asked Questions

What disqualifies you for unemployment in Texas?

In Texas, if you become unemployed by your own actions, earn insufficient wages during the base period, or face termination for misconduct, you won’t qualify for unemployment benefits.

What disqualifies you from unemployment in Georgia?

In Georgia, you won’t receive unemployment benefits if you can’t work due to physical reasons, take personal leave, go on vacation, face dismissal for misconduct or poor performance, or decline or neglect to apply for suitable employment without a valid reason.

What disqualifies you from unemployment in California?

In California, leaving your most recent work without good cause or being discharged for misconduct related to your most recent work will disqualify you from unemployment benefits.

What disqualifies you from unemployment in Alabama?

Being dishonest or criminal at work, suspended as a disciplinary measure connected with your work, quitting without good cause, and having gross weekly earnings higher than the weekly benefit amount will all disqualify you from receiving unemployment benefits in Alabama.

How are weekly benefit amounts calculated for unemployment benefits?

Weekly benefit amounts are determined by looking at wages earned during the base period, which is the first four of the last five completed calendar quarters.

Should you find yourself in need of guidance or support, please remember you’re not alone. Our team of expert consultants at the Assistance HUB is always ready to assist you. Whether you have questions, concerns, or simply need advice, don’t hesitate to reach out. We’re here to help, ensuring you have the resources and understanding you need. Visit the Assistance HUB page and let our experts guide you towards a brighter path